How to Ace the Psychology Behind a Market Cycle

- Marketing @MeetVentures

- Nov 4, 2025

- 2 min read

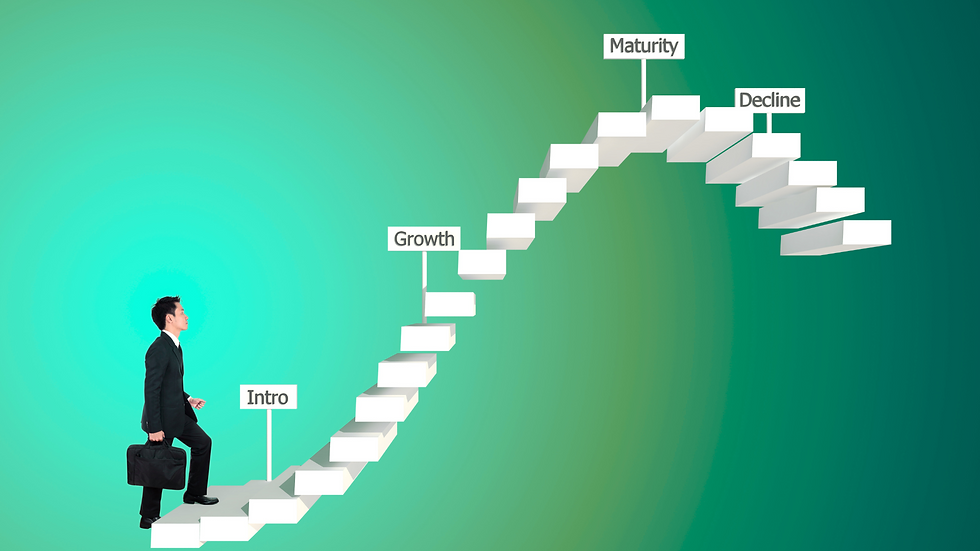

Market cycles aren’t just about numbers and charts—they’re deeply shaped by human behaviour.

Understanding the psychology behind these cycles gives investors a real edge, enabling smarter moves while others react emotionally.

Phase 1: Optimism and Early Growth

Cycles often begin after a downturn, when confidence returns and early investors spot new opportunities.

The key: identify trends early, using solid research—not just following the crowd.

Phase 2: Euphoria and Overconfidence

Momentum grows, prices soar, and overconfidence sets in. Fear of missing out (FOMO) takes over, and warning signs get ignored.

The pros recognize this phase and start quietly reducing exposure to overvalued assets.

Phase 3: Anxiety and Denial

The first slowdown signs appear. Many dismiss them, hoping the good times will last. But denial is costly.

Smart investors accept reality early, reallocating to safety or prepping for the next upturn.

Phase 4: Fear and Capitulation

Markets drop fast, panic selling hits, and emotions rule. Many sell at the bottom.

Those who stay disciplined can snap up quality assets at a discount.

Phase 5: Recovery and Renewal

Eventually, optimism returns and the cycle resets.

Investors who understood each phase are ready to seize new opportunities.

Practical Tips to Master Market Cycle Psychology

Keep emotions in check and let data drive your decisions

Focus on the long term—don’t panic during swings

Study history to spot repeating patterns

Diversify to cushion any one phase

Conclusion

Mastering market cycles means understanding both human nature and hard data.

By staying rational, patient, and prepared, you can turn cycles to your advantage.

Meet Ventures helps founders and investors navigate these realities. Contact us to see how we can support your strategy for long-term success.

Comments